In late November, Protos began demystifying the mysterious ties of the bankrupt and fraud-riddled cryptocurrency exchange FTX to “a small bank in rural Washington,” known as Farmington State Bank. Given that it has only 3 employees and is one of the smallest banks in the entire United States, Protos noted that “the fact that [this bank] somehow finds itself embroiled in the largest cryptocurrency fraud in history is puzzling, disconcerting, and totally out of place, to say the least.”

While the Protos piece sheds some light on Farmington State Bank and its recent transformation into FBH Corp. and Moonstone Bank, there is more to the story. Despite being a small, rural bank, Farmington/Moonstone, since at least 1995, has had ties to some of the most covert and criminal offshore financial networks of the modern era, with connections to intelligence-linked financial fraudsters of considerable notoriety.

In this Unlimited Hangout investigation, we pick up where Protos left off and begin lifting the curtain behind the FTX financial labyrinth in an effort to piece together the networks behind the elaborate crypto Ponzi scheme. This is critical work, as the FTX bankruptcy proceedings have been oddly manuevered so to avoid revealing who aside from Sam Bankman-Fried, the disgraced CEO and face of FTX, had control of the exchange and its subsidiaries. The network behind Farmington/Moonstone, the subject of this piece, is the first of many threads tied to FTX that we hope to pull on in the coming weeks and months.

Archie Chan Finds Farmington

Farmington, a sleepy rural town in Washington state, saw its once promising economic fortunes turn to dust during the Great Depression of the 1930s. The Great Depression had also crushed the first iteration of Farmington State Bank, originally founded in 1887, and a new bank of the same name was created in May 1929. Much of Farmington State Bank’s history is hardly noteworthy. Joining the bank in 1973 was C. Wayne Wexler, who served as the bank’s president for over a decade. Throughout the 1970s, the bank held around $1.5 million in deposits, which grew modestly during the 1980s to around $3.5 million.

Around 1995, Farmington, for reasons still unknown, attracted the attention of a British citizen residing in Hong Kong named Archie Chan. According to a 2010 interview given by Farmington’s then-president, John Widman, Chan bought the bank in 1995 “when he was looking for a chartered Washington bank that might become a platform for international banking.” Though this never came to pass, Chan’s connections suggest that his interests in the small, rural bank may have been manifold.

Chan acquired Farmington through a holding company registered in the British Virgin Islands (BVI) called Farmington Finance Corporation. The lawyer who aided him in setting up the corporate structure for the new Farmington organization was David K.Y. Tang, who – among other things – is a member of the Council on Foreign Relations (CFR). Tang, whose careers in law and business spans Seattle, Hong Kong and Beijing, also served a stint as chairman of the Federal Reserve Bank of San Francisco—the central bank branch that has technical legal oversight of Farmington. According to a different Protos investigation, this same component of the Federal Reserve system “took over regulatory duty for [Farmington/Moonstone] earlier this year, but seems to have glossed over Moonstone’s for-profit foreign interests.”

Though it remained under BVI jurisdiction, annual reports from Farmington State Bank reveal that Chan’s Farmington Finance Corporation maintained its offices in the Jardine House in Hong Kong. That property is owned by the interests of Jardine Matheson Holdings. That company is the successor to Jardine Matheson & Co, one of the largest foreign trading companies in the Far East for much of the 19th century which was extensively involved in entrenching British political and economic influence in Hong Kong. It also played a key role in the opium trade. Notably, Archie Chan has claimed to be “a member of one of the oldest and most prominent Hong Kong families,” suggesting a potential familial link to the power networks of early colonial Hong Kong, where Jardine Matheson was particularly prominent. Later, Chan’s Farmington Finance Corporation relocated to St. George’s House, also in Hong Kong.

Further investigation into Chan reveals that he was, until relatively recently, the executive director of Glorious Sun Enterprises. Glorious Sun Enterprises is the main company of its parent organization, the Glorious Sun Group. The latter began as a textile concern in Hong Kong in the mid-1960s, later expanding into the fields of finance, real estate and other ventures during the 1980s. It now boasts property holdings in Hong Kong, China, Singapore, Canada and the United States.

Chan’s association with the Glorious Sun business complex has been long-running. According to SEC filings, he became the company secretary of Glorious Sun Enterprises Limited in February 2005, and then joined the corporate board as a director in August of that same year. However, over two decades before this, Chan had been acting as the group’s primary “business consultant”, a position that required him manage the various partnerships and subsidiaries that made up the fledgling empire’s vast reach. Documents submitted by Glorious Sun to the SEC state that he would act as a director in various joint-ventures where Glorious Sun controlled 50% of more of company stock. Chan, in other words, was Glorious Sun’s chief business agent at the time that he purchased Farmington State Bank.

Glorious Sun Enterprises is mostly held by Glorious Sun Holdings Limited, followed by Advancetex Holdings. Other shareholders include members of the Yeung family, some other executives and the Texas-based Dimensional Fund Advisors LP. Both Glorious Sun Holdings Limited and Advancetex were registered at the address 263 Main Street in Road Town, the capitol city of the British Virgin Islands (BVI). This is location of CCS Trustees Limited, a corporate services firm that handles the legal registration for business seeking to set up holding companies or subsidiaries in offshore tax havens like BVI. CCS Trustees itself seems to have a focus on Hong Kong-oriented business, and even maintains a subsidiary called Cayman-Hong Kong Corporate Services Ltd. CCS’s founder, William Au-Yang, sits on the board of the New Media Group, a Hong Kong-based telecommunications firm.

According to SEC filings from 2007, Glorious Sun’s principal bankers include the Hongkong and Shanghai Banking Corporation (more commonly known as HSBC) and Standard Chartered Bank. The former has had a historically close-knit relationship with Jardine Matheson: the two have engaged in joint-ventures with one another, while members of the controlling family of Jardine Matheson, the Keswicks, have often held leadership positions at HSBC. Standard Chartered, meanwhile, is closely tied to the Inchape family, a fixture of the British ruling class with numerous concerns in global shipping and manufacturing.

When it comes to dealing with stock issuance and other business affairs in the United States, Glorious Sun retained the services of the Bank of New York (now BNY Mellon), a banking institution with a notorious history of involvement in organized crime-linked money laundering and capital flight. Glorious Sun itself has maintained a strong presence in New York City, where it has been an active player in the world of Manhattan real estate. Their New York-based activities have included partnerships with Polylinks International, a consortium of leading Hong Kong families that has invested heavily in the real estate markets in New York, San Francisco, London, and elsewhere. Polylinks is best known for its 1994 deal—which Glorious Sun did not participate in—with Donald Trump. When the future president found himself saddled with a number of debts and was unable to pay what he owed for the construction of his troubled Riverside South project, Polylinks stepped in and effectively took control of the development. In 2005, portions of Riverside South were sold to the Carlyle Group.

A Deeper Look at Glorious Sun

The chairman of Glorious Sun is entrepreneur and billionaire Charles Yeung. Hailing from China’s Guangdong province, Charles and his brother, Yeung Chun-fan, founded Glorious Sun as a small-scale operation in the 1960s. Today, the brothers own the majority Glorious Sun through the fairly complex structure of holding companies mentioned above. They are significant stakeholders in Glorious Sun Holdings and in Advancetex Holdings, which has larger stock holdings in Glorious Sun’s various corporate units.

The rapid success of Glorious Sun propelled the Yeung brothers—Charles in particular—to the heights of not only economic, but political power in Hong Kong. He served on the Provisional Legislative Council, a special legislative body set up during the handover of Hong Kong from the United Kingdom to the People’s Republic of China. This is illustrative of Charles Yeung’s position within the “pro-business, pro-Beijing” wing of Hong Kong’s ruling class. He has also been affiliated with the One Country, Two Systems Research Institute think-tank and with the Hong Kong Progressive Alliance, a business-led political party that has had ties to liberal factions in the Communist Party of China. Yeung has also been active in the Democratic Alliance for Betterment and Progress of Hong Kong, which absorbed the Hong Kong Progressive Alliance in 2005.

Charles Yeung also appears to have maintained a presence in Macao, the former Portuguese colony that, since the late 1990s, has been one of China’s special administrative regions. The economies and banking systems of Macao and Hong Kong have been closely intertwined: for decades, the city was known as one of the world’s premier zones for the (then-illicit) gold trade, which was heavily fueled by Hong Kong banks and their international partners— with HSBC being one particularly notable example. Important gold smuggling institutions in Macao included Seng Heng Bank. For many years, the controllers of Seng Heng were a small syndicate that included Ho Yin, a gold smuggler with close ties to the Chinese Communist Party, and Cheng Yu-tung, the founder of Hong Kong’s New World Development Company. New World would later be involved with the Polylinks consortium that took control of Donald Trump’s Riverside South real estate project.

In the early 1980s, Ho Ying, Cheng Yu-tung and their partner, Lu Daohe, sold Seng Heng to Arkansas political kingmaker—and seasoned traveler in the worlds of international commerce and intelligence operations—Jackson Stephens, as well as his close friend and banking partner, Mochtar Riady. This purchase curiously took place the same year that Stephens and Riady took control of Worthen Bank in Arkansas, an entity closely connected to Little Rock’s Rose Law firm and the rising political fortunes of the Clintons. As for Seng Heng, Stephens and Riady unloaded the bank in 1989 to STDM. This company, founded by Hong Kong-Macao billionaire businessman Stanley Ho, held a monopoly over Macao’s gambling industry. Ho himself has been haunted by numerous accusations of association with organized crime elements that operate in Macao’s underworld.

This is where Charles Yeung re-enters the picture. When STDM purchased Seng Heng from the Stephens-Riady syndicate, it maintained 100% ownership and placed its own directors and executives on the bank’s board. In 2007, a major stake in Seng Heng was sold to the Industrial and Commercial Bank of China (ICBC). Due to the wariness that various businesses showed when it came to dealing with Seng Heng, largely due to its reputation as a “casino bank”, ICBC set out to revamp the bank’s image. It dispensed with a handful of the old directors—figures like Stanley Ho, however, stayed on with the board—and replaced them figures that exemplified a new corporate ethos. Charles Yeung was one of ICBC’s new appointees.

Yet Yeung himself had been plagued with accusations of involvement with money laundering, particularly as it related to Glorious Sun’s operations in the Philippines. Glorious Sun set up a manufacturing base there in 1976, which grew into the Philippines’ second largest apparel exporter by 1983. This shift, which was part of Glorious Sun’s efforts to move its manufacturing out of Hong Kong in search of lower costs, happened alongside a thaw in the China–Philippines relationship. For much of the Cold War, the government of Filipino president Ferdinand Marcos was stalwartly anti-communist, and maintained close ties to the PRC’s rival, the Kuomintang (KMT) or Nationalist Chinese. Likewise, Marcos closely collaborated with the pro-KMT “China Lobby” in the United States.

According to Sterling and Peggy Seagrave, the roots of the thaw can be traced to an arrangement, made in the context of the Nixon-Kissinger overtures to China, to bolster foreign currency reserves in Chinese-owned banks by the infusion of gold and other metals and cash held by the Marcos family. A documented trail exists showing that, during the 1970s, an incremental but steady flow of capital was deposited into various banks in mainland China and in Hong Kong.

Glorious Sun was accused of participating in the smuggling of Filipino wealth abroad as it was pilfered by the Marcos family through a complicated series of transactions and orders between the Philippines and Hong Kong. A legal complaintfiled with the Philippines’ Supreme Court charged that Yeung and other Glorious Sun executives “acted as fronts or dummies, cronies or otherwise willing tools of spouses Ferdinand and Imelda Marcos… in the illegal salting of foreign exchange.” They purportedly did this by “importing fabrics from only one supplier… at prices much higher than those being paid by other users of similar materials”. Other documents from this case show that Archie Chan was also identified as a participant in the scheme.

In the end, Glorious Sun was acquitted of any involvement in “dollar salting” (i.e. the movement of capital out of the country without the approval of the Philippines’ central bank)—but it was under peculiar circumstances. Other case filingsnote that “the court held that the documentary evidence relevant to this allegation [against Glorious Sun] was INADMISSABLE for being mere photocopies”.

That Glorious Sun, and Archie Chan, would have connections to the Marcos family and their financial schemes is significant as other key players that enabled those schemes intersect with the Jeffrey Epstein-Ghislaine Maxwell network explored in One Nation Under Blackmail. One of Marcos family’s main accomplices was none other than arms dealer and intelligence asset Adnan Khashoggi. Key to Khashoggi’s murky finances in the 1980s was Jeffrey Epstein, who – for an unspecified period – was hired by Khashoggi for the purposes of either finding or hiding large sums of “looted” money (Epstein likely helped Khashoggi with both). Another top “financial adviser” to Imelda Marcos was actor George Hamilton, who – in the early 1990s – was a confidant and vacation companion of Ghislaine Maxwell right up until she publicly aligned herself with Jeffrey Epstein shortly after her father’s death in 1991.

Glorious Sun may have additional ties to this network via Mast Industries, a Hong Kong-based export-import firm with a specialty in textile goods sourced from elsewhere across Asia. During the early 1970s, Leslie Wexner contracted with Mast to supply fabrics to be used for his corporate flagship, The Limited. By the end of the decade, Wexner purchased Mast and it became a major subsidiary of his corporate empire.

While this is currently no evidence that indicates that Glorious Sun used the services of Mast Industries (though it would not be surprisingly, given its status as one of Hong Kong’s major apparel companies), there are nonetheless connections between the two companies. During the late 1970s, Mast Industries formed a joint-venture called Sinotex, with the Crystal Group Limited, yet another Hong Kong-based apparel manufacturer. A review of the affiliations of the Crystal Group’s founder, Kenneth Lo, shows that he moves in many of the same circles as Glorious Sun’s Charles Yeung (for example, both are honorary vice-chairmen of the Hang Seng University of Hong Kong). The head of the Crystal Group’s intimates division, meanwhile, is Lo Wing Sing Eddie, who had previously served as the managing director of Glorious Sun’s major subsidiary, Jeanwest.

Aside from Glorious Sun and the Yeung family, Archie Chan has another connection that is worth noting. In 2009, Chan was made a Knight Commander of the Royal Order of the Kingdom of Poland. His sponsor was Paul Kan Man-Lok, a Hong Kong technology-focused businessman who had previously “been honored by Queen Elizabeth and numerous Heads of State for his humanitarian service.” Paul Kan is the founder and chairman of Champion Technology Holdings. Like Glorious Sun and Chan’s Farmington Finance Corporation, Champion Technology has made use of holding companies set up in the Road Town, BVI.

Kan’s Champion Technology has maintained a long-standing relationship with the People’s Liberation Army (PLA), the PRC’s primary military organization. The PLA has been an active player in the worlds of Chinese and Hong Kong business, operating both overt and covert fronts for both the acquisition and development of cutting-edge technology. As recounted in a 1997 Forbes article, Kan found himself partnering with the PLA in the late 1980s, when he hoped to set up a Champion Technology division in China dedicated to radio paging technology. “The bureaucrats at the Ministry of Posts & Telecommunications dithered”, the article recounts, “but companies owned by the military jumped at the chance… Kan… now has paging franchises in dozens of cities across China, mainly through partnerships controlled by local units of the PLA.”

Changing Hands

As noted last week by Protos, Archie Chan is alleged to have essentially done nothing with Farmington State Bank from 1995 until relatively recently. However, his connections suggest that there may have been more to his use of the bank, or at the very least his Farmington Finance Corporation, than meets the eye. In 2020, Chan sold the bank to FBH Corporation, which was incorporated in 2019 and whose chairman is Jean Chalopin, a “seasoned entrepreneur” who went from playing a major role in children TV programming in the 1980s and 1990s to the largest shareholder of Deltec Bank and Trust and, subsequently, its chairman. It remains unknown if Chalopin knew Chan prior the sale and how or why Chalopin became interested in the tiny, Washington-based bank.

Shortly after Farmington was sold to Chalopin’s FBH Corp., Chalopin joined Farmington’s board of directors. Notably, Deltec Bank and Trust, where Chalopin is chairman, was described by Protos as “one of the main banks for both Alameda Research [FTX’s trading arm that played a central role in its collapse] and Tether.” As noted by investigative journalist Nicola Borzi, Deltec ties back to the network behind the extreme corruption and insider trading of Kidder Peabody and Drexel Burnham Lambert in the 1980s (the connections of which to shadow banking and Jeffrey Epstein are detailed in One Nation Under Blackmail) as well as to intelligence-linked figures like Armand Hammer. More on the FTX-Deltec Bank connections will be discussed shortly.

Chan sold Farmington to a company based in Baltimore called GUVJEC Investment Corporation, of which Chalopin is president, GUVJEC, however, was originally created by Robin Trehan, a self-described banking and fintech advisor whose focus is on “is on bringing blockchain tech to the masses by integrating the fintech industry and traditional banking.” His LinkedIn says he has been a partner of Chicago-based Credit Capital Funding for decades. However, Trehan is a Senior VP of Deltec International, the parent company of Deltec Bank and Trust. Trehan oddly excludes this from his LinkedIn profile.

Trehan and Chalopin are listed as executive officers of FBH Corp., according to SEC filings from earlier this year, in February. Listed as directors of FBH are Noah Perlman and Gary Rever (referred to in filings as A. Gary Rever). Perlman at the time of FBH Corp’s incorporation was Chief Compliance Officer of the crypto exchange Gemini. He is now Gemini’s Chief Operating Officer, a position he has held since 2020. Notably, the implosion of FTX caused someproblems for Gemini, which temporarily halted withdrawals from its “Gemini Earn” program due to fallout tied to the FTX bankruptcy. The FTX implosion had affected the main lender of that Gemini program, Genesis. Past reports suggestthat Perlman was involved in Gemini’s 2021 decision to partner with Genesis. Again, like Trehan, Perlman excludes any mention of his role at Moonstone from his LinkedIn profile.

Soon after its purchase by the Chalopin-led FBH Corp, Farmington “pivoted to deal with cryptocurrency and international payments,” but encountered problems moving money. It resolved these issues by seeking Federal Reserve approval and became part of the Federal Reserve System in June 2021.

In March of this year, Farmington State Bank trademarked the name Moonstone Bank and adopted that name three days later. Four days after that, on March 7, FTX’s trading arm, Alameda Research, invested $11.5 million into FBH Corp/Moonstone Bank. At the time, Chalopin stated of the investment that “Alameda Research’s investment into FBH Corp and Moonstone Bank signifies the recognition, by one of the world’s most innovative financial leaders, of the value of what we are aiming to achieve. This marks a new step into building the future of banking.” It still remains unknown what this multi-million dollar investment was for, though Moonstone’s Chief Digital Officer Janvier Chalopin, the son of Jean Chalopin, told Protos that the investment was “seed funding … to execute our new plan of being a tech-focused bank.”

The exact same day that this significant investment was announced, Ronald Oliveira was installed as Moonstone’s Chief Executive Officer, until he left Moonstone in August for reasons that are still unclear. Part of the confusion relates to an incongruity between claims from Moonstone executives about the reason for Oliveira’s departure (that he had gotten a job “opportunity he couldn’t refuse”) and what Oliveira has publicly written about his work since leaving the bank (that he is now working as a self-employed consultant).

Prior to joining Moonstone, Oliveira had been the US CEO for Revolut, “a global fintech headquartered in the UK.” The press release which discusses both the investment and Oliveira’s new role at Moonstone states that Oliveira had “engineered Revolut’s official public entry into the US.” Revolut was created by NJF Capital in 2015 to be a “leading digital alternative bank.” NJF Capital was founded and is run by Nicole Junkermann, a former model and close, intimate associate of sex trafficker and financial criminal Jeffrey Epstein. Junkermann was allegedly involved in major aspects of his sex blackmail activities, including the sex blackmail of two sitting US senators in the early 2000s, and later played a key role in intelligence-linked firms that Epstein had funded, such as Carbyne 911. It is unknown if the Alameda investment in Moonstone had influenced the decision to hire Oliveira or vice versa, though neither is outside the realm of possibility.

This is partially because the controversial stablecoin Tether also banks with another Chalopin-directed bank, Deltec Bank and Trust. A recent investigation by Revolver News detailed the ways that Tether has shown signs of itself being a Ponzi Scheme, not unlike FTX. The investigation also noted that the stablecoin’s co-founder, Brock Pierce, boasts connections to Jeffrey Epstein. Pierce, a former child actor in Disney films, had previously been a co-founder and an executive at Digital Entertainment Network (DEN), where he and other executives were accused of sexual assault. The case against Pierce was dropped after Pierce paid a considerable sum to one of the plaintiff’s lawyers. However, his co-defendant Marc Collins-Rector, the other co-founder of DEN, was indicted on criminal charges. When Collins-Rector was arrestedby Interpol in 2002, the Spanish villa he shared with Pierce was found to contain rifles, machetes and child pornography. DEN, during its brief existence, produced a program that was described as a “gay pedophile version of Silver Spoons.”

As for Tether itself, not everyone believes it to be a Ponzi Scheme, as suggested by the aforementioned report published by Revolver News. For instance, Marty Bent, a well-known bitcoiner who runs TFTC.io, told Unlimited Hangout that Tether was able to quickly process $10 billion in withdrawals following the collapse in price of the TerraUSD/Luna cryptocurrencies this past May. This would suggest that Tether does indeed have the reserves at Deltec Bank and Trust that it claims to have. Bent suggested that Tether, instead of being a Ponzi Scheme, was “extremely high risk” and at the mercy of US regulators and other financial authorities. It has since been reported that Sam Bankman-Fried of FTX is now under investigation for the potential role played by FTX, Alameda Research and the aforementioned Genesis Trading in the manipulation of TerraUSD/Luna prices earlier this year, leading to the crash in their value in May.

In addition, as noted by Dirty Bubble Media, Tether’s previous banking partner prior to the Chalopin-led Deltec, Crypto Capital, was caught laundering money for drug cartels (something the aforementioned HSBC has also been caught doingon a massive scale). In addition, Dirty Bubble Media noted that Tether’s leadership has also paid large fines for lying about the state of their reserves, which are ostensibly held by Deltec. Furthermore, Tether’s CFO and CEO were involved “in one of the largest VAT tax evasion schemes in European history.”

As previously mentioned, Alameda Research was also considerably involved with Chalopin’s Deltec Bank and Trust, as were other companies tied to the FTX web of companies and Sam Bankman-Fried. These connections between the FTX web and Deltec existed at the time of Alameda’s mysterious investment into FBH Corp/Moonstone Bank. Documents produced by John Ray, the newly-appointed CEO of FTX following its bankruptcy, revealed that FTX and affiliated companies/subsidiaries had a total of 17 accounts at Deltec. Most of these accounts were associated with Alameda Research and West Realm Shires Services, both of which were ultimately controlled by Sam Bankman-Fried. Those 17 accounts were held in a variety of currencies according to reports, including US dollars, euros, Swiss francs, Canadian and Australian dollars and the British pound sterling. Rumors circulated in recent weeks that FTX’s connections to Deltec had enabled the latter to acquire Ansbacher, another Bahamas-based bank, earlier this year. However, Deltec hasvigorously denied the allegations. Deltec has also, notably, declined to comment on any details of their relationship with entities controlled by Sam Bankman-Fried or tied to FTX. The Deltec-Tether association and the Deltec-FTX/Alameda association seem to be suggestive of a pattern for the Chalopin-led Deltec. Those associations also seem suggestive as to why Chalopin would seek to acquire Farmington/Moonstone Bank from someone like Archie Chan.

Regardless of the real story behind Farmington’s transformation into Moonstone and Alameda’s decision to invest in the bank shortly thereafter, the amount of deposits held by the bank jumped considerably after these developments. As noted by Protos, after “consistently report[ing] deposits hovering around $10 million for decades,” the bank reported $84 million in deposits in the third quarter of 2022. $71 million of those deposits were from just four new accounts.

The Protos report concludes the following:

“No one is able to ascertain what the $11.5 million investment from Alameda Research was for, no one can explain why a small, rural bank in southeastern Washington state would be used to move millions of dollars by Alameda, and no one can fully explain the connections between Farmington, Deltec, FTX/Alameda and Tether. Not to mention, it remains unclear how a Bahamas-based company like FTX, with ongoing investigations by top financial watchdogs, was able to purchase a stake in a federally approved bank.”

These points were also raised by the New York Times, which quoted Camden Fine, a bank industry consultant as saying:

“The fact that an offshore hedge fund that was basically a crypto firm was buying a stake in a tiny bank for multiples of its stated book value should have raised massive red flags for the F.D.I.C., state regulators and the Federal Reserve…It’s just astonishing that all of this got approved.”

Moonstone and the “bridge” to CBDCs

Just a few weeks before the implosion of FTX, in late October, Moonstone Bank partnered with a little known company called Fluent Finance in order to “accelerate crypto adoption by issuing US+ stablecoin.” That partnership is described as allowing “Fluent and Moonstone Bank to connect the traditional financial system to the emerging Web 3 economy.”

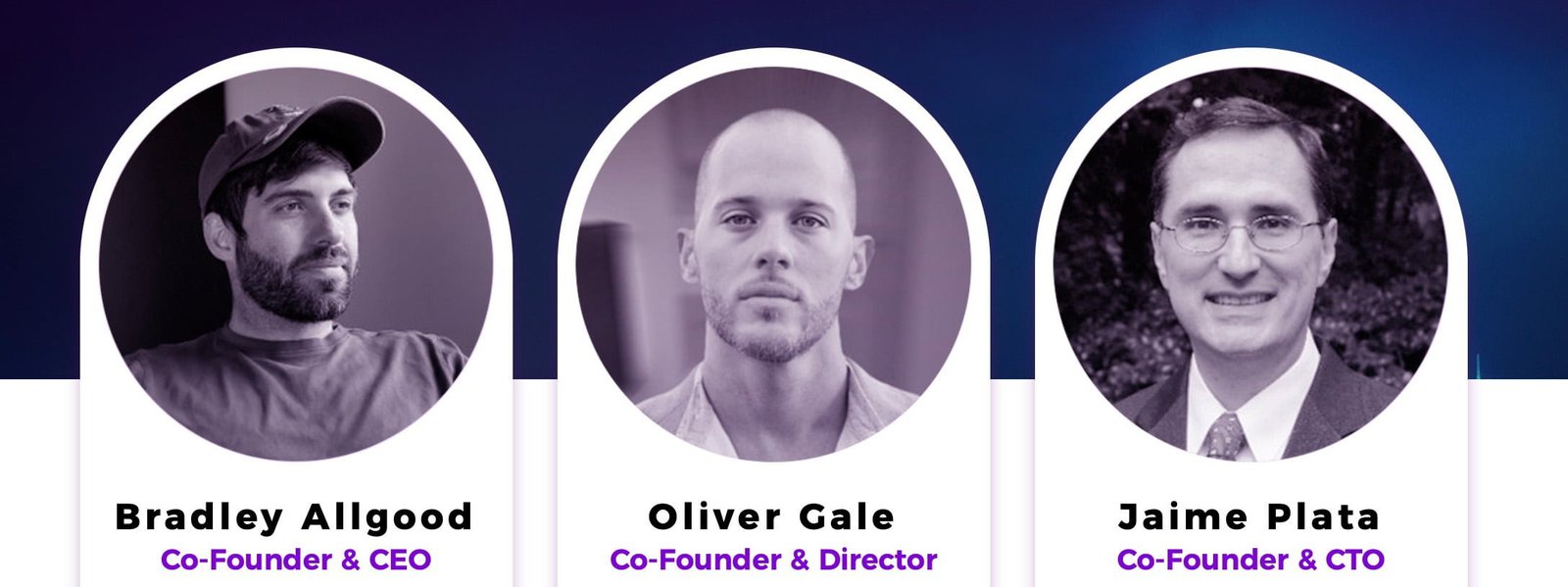

Fluent Finance has three co-founders: Bradley Allgood, Oliver Gale and Jaime Plata. Though Allgood is often put out as the face of the company, it is Gale and Plata who merit the most attention. Oliver Gale is the self-described “inventor” of the Central Bank Digital Currency (CBDC), as he was the mastermind behind the Eastern Caribbean Digital Dollar. Gale reportedly left the program due to its “ideological shift” toward a “permissioned blockchain” model that affords central banks unprecedented control over the money it prints. However, today, Gale, despite his pro-privacy posturing, is “not entirely against CBDCs, provided they run on infrastructure that doesn’t endanger their users.” Articles have noted Gale’s influence on major CBDC policy papers that have the backing of the world’s most powerful financial institutions and central bankers, such as those published by the CBDC think tank. Jaime Plata has worked as a “strategic advisor” to the Eastern Caribbean Central Bank, where he collaborated on Gale’s digital dollar project by helping the bank “replace their Core banking application, integrate CBDCs and a real time gross settlement system.”

Fluent Finance’s US+ stablecoin is designed to act “as a technological bridge, connecting legacy [e.g. existing] banking systems and digital finance.” It is openly promoted as being compatible with CBDCs and as having “built-in digital identity standards.”

It is certainly interesting that two banking interests tied to Jean Chalopin, Deltec and Moonstone, both have intimate partnerships with dollar-based stablecoins, Tether and now US+. If Tether is set to unravel in the wake of FTX’s collapse, as some believe, US+ seems designed to be the “trustworthy” counterpart meant to herd the “legacy” financial system into the CBDC era, where central banks will have total control. However, this could have been a move aimed at fulfilling Sam Bankman-Fried’s ultimate ambitions for FTX, which was to turn FTX into the “everything exchange” and the “everything app.” In other words, FTX aimed to be the main force in the fintech space globally.

While such dreams have been shattered in the wake of FTX’s implosion, the exchange’s efforts to expand into every asset class invariably led to its expansion through a labyrinthian network that is still only beginning to unravel. However, as this investigation has endeavored to show, the connections revealed by pulling on the single thread of its relationship with Farmington State Bank reveal that the corrupt actors and entities in this story extend far beyond Bankman-Fried and FTX.